Economic Growth Under Biden Exceeds Forecasts Again

Update: May 2024 - May's employment gains and falling inflation numbers provided more evidence that the U.S. economy continues to be strong, thank you, despite the story certain politicians are trying to peddle this election year.

On the employment front, 272,000 non-farm jobs were created last month, again exceeding Wall Street's expectations, this time by 92,000. On the inflation front, the Consumer Price Index was unchanged over April and up only 3.3% over May of 2023.

Both numbers were lower than economists' forecasts and has led to expectations that the Federal Reserve will reduce interest rates at least once this year, if not twice.

Add to this the fact that the average hourly wage has risen 4.1% since last May, and you've got the consumer continuing to make up for the Covid-induced inflation that hit us in 2022.

Update:_March 2024 - With the forecasted increase for job growth in March centering around the 200,000 number, the unexpectedly robust results that actually came in for the month once again surprised the heck out of Wall Street and business economists: 303,000 jobs were created in March and the unemployment rate fell to 3.8%. The latter number was the 26th consecutive month below 4%, the longest stretch since the 1960's, when Democrats held the White House (JFK and LBJ) and when the Dems also had majorities in both Houses of Congress.

(Image from Getty) (Image from Getty)

Some of the reactions to the March jobs report included:

- "Eye-popping" - senior economist Sam Bullard of Wells Fargo.

- "The data leaves us borderline speechless" - Thomas Simons of Jefferies.

- "This is a strong labor economy that shows little sign of stalling in the near term" - Jim Baird, chief investment officer at Plante Moran Financial Advisors.

- "The March jobs report was a very good one, with no red flags" - Gus Faucher, chief economist at PNC Financial Services.

Progress on inflation continued in March as well. With the exception of auto insurance and rents, the rate of increase for all other major categories of goods and services fell once again. Some of these categories even reflected falling prices (i.e., deflation!) and virtually all of the 28 categories were a) within a range most economists find acceptable and b) less than the wage increases of recent months. The latter indicates that workers are catching up on the worldwide post-Covid inflation that resulted from the re-opening of the world's economies and from Russia's invasion of Ukraine.

Update:_January 2024 - When Larry Kudlow, former economic advisor to Donald Trump, is interviewed on Fox News and he praises both the January jobs report and Joe Biden, you know the economy is doing well. One of the reasons for Mr. Kudlow's upbeat analysis was that January saw non-farm payrolls increase by 353,000 jobs, which far exceeded the 185,000 expected. In addition, the December job numbers were revised upward from 216,000 to 333,000!

Not only did the number of jobs increase in January, but the average hourly pay rate also increased in January, rising another 19 cents to $34.55. Since the spring of last year, pay increases have exceeded inflation, giving consumers a net gain in their purchasing power, which also helps fuel economic growth.

Professional and business services led the way in January with a gain of 74,000 workers; health-care jobs increased 70,000; and manufacturing continued to grow, up another 23,000 in January. (Be sure not to miss our recent article "Construction of U.S. Factories is Booming Under Biden".)

(Job growth continues to exceed forecasts) (Job growth continues to exceed forecasts)

Update:_December 2023 - Another monthly jobs report and another month of results exceeding forecasters' expectations. Specifically, December saw 216,000 new jobs added to the U.S. economy, beating the consensus estimate of ~170,000. The unemployment rate remained unchanged at 3.7 percent.

Sectors of note included education and healthcare, which led the job gain numbers with an increase of 74k workers; leisure and hospitality (+40k); construction (+17k); and manufacturing (+6k).

As a result, job gains for the entire year of 2023 totaled 2.7 million, the fifth highest increase since 2000. Pretty darn good for a year which saw the Federal Reserve continue to decrease the money supply and increase interest rates, and where 90% of CEO's surveyed a year ago said they expected a recession at some point in 2023.

Update:_November 2023 - It's been a strong summer and fall for the U.S. economy with job growth moderating, but continuing to exceed expectations, and inflation falling by almost 70% from a year ago. Let's look at some of the numbers in detail:

- The U.S. economy grew at a 5.2% annualized rate during the third quarter (Q3) of this year. Annual GDP growth since WW2 has averaged in the 2-3% range. Economists attribute the Q3 growth to continued solid consumer spending, a surprising increase in housing investment, and an increase in government spending (thanks to the Biden infrastructure initiative and the Democrat's Inflation Reduction Act).

(image from AP) (image from AP)

- As of November, the year-over-year inflation rate fell to 3.2%, after hitting a high of 9.1% in June of last year. Much of this is due to the post-pandemic supply chain issues having been resolved. In addition:

- Despite OPEC (comprised primarily of Russia, Venezuela, and the Middle East Arab nations) having reduced their production of oil in order to keep oil prices high, the U.S. oil and gas industry has been increasing output; hence, the lowest gasoline prices we have seen for quite a while.

(image from AP) (image from AP)

- The U.S. unemployment rate fell from 3.9% in October to 3.7% in November, marking the 22nd consecutive month this key economic indicator has been below 4.0%.

- Job gains have averaged roughly 200,000 per month over the summer and fall, including November's 199,000 gain, which exceeded the consensus estimate of 190k.

- Lastly, good news from the American worker perspective: average hourly earnings are up 4% this year, which is higher than the rate of inflation.

All of this is very encouraging, particularly given the Federal Reserve's tight monetary policy, which has resulted in the high interest rate environment we now are experiencing. Let's hope this interest rate approach of the Federal Reserve will start to moderate, so their actions don't adversely impact the positive news we're seeing in the rest of the economy.

Update:_May 2023 - Wall Street job growth projections were blown away yet again in May as non-farm payrolls rose by 339k, exceeding those Wall Street forecasts by 144,000. Following the release of May's numbers, the Dow-Jones Industrial Average finished the day with a gain of over 700 points, or 2.1%. The broader-based S&P 500 Index was up almost 1.5% and the tech-heavy NASDAQ jumped 1.1%.

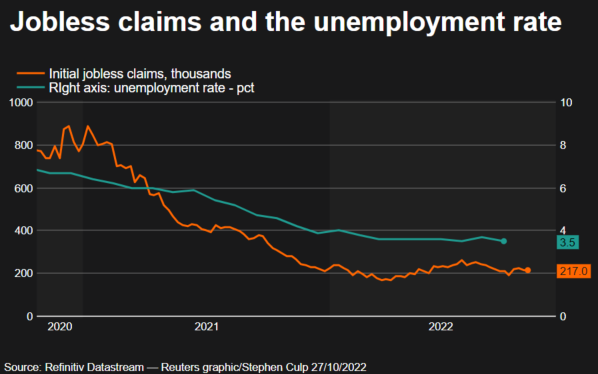

Unemployment (which is calculated through a different survey) increased slightly to 3.7%, which economists attributed to a decline in self-employment. We're still concerned that the Fed's monetary policies are trying to push the U.S. economy into a recession, so we'll be keeping an eye on this number. Apparently the stock market wasn't too concerned, though.

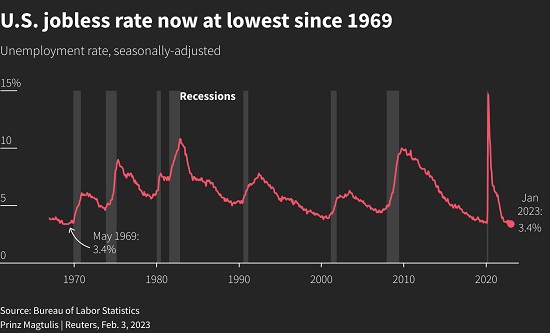

Update:_April 2023 - Another month of higher than expected job growth has led to a 50-year low in the U.S. unemployment rate. That key economic statistic fell to 3.4%, as America's employers continued to confound Federal Reserve policy by hiring another 353,000 workers. Wall Street economists had forecasted payrolls to increase by only 185,000 and had expected the unemployment rate to remain constant at 3.5 percent.

Add to this the fact that inflation fell for the 10th consecutive month and we again find quantitative support for an economy that is moving in the right direction. The U.S. Consumer Price Index increased by only 4.9% in April, lower than the consensus expectation of 5.0% and the lowest annual increase since April of 2021. Fruit, vegetables, eggs, dairy products, etc. all fell in price last month, although used car prices ticked up after having fallen for nine months in a row.

Update:_March 2023 - There was good news on both the employment front and the inflation front in March. U.S. non-farm payrolls increased by 236,000 and the Consumer Price Index increased only 0.1% (that's one-tenth of one percent) over February. That inflation number equates to less than a 2% annual rate, the 2% number being the Federal Reserve's target for an acceptable amount of inflation in a growing economy.

March's job gains were in line with economists' forecasts, which averaged 230k - 240k. In a bit of a surprise, though, the unemployment rate fell to 3.5%, with black unemployment falling to an all-time low of 5.0%. These unemployment decreases occurred at the same time as the labor force participation rate increased to 62.6%.

Leisure and hospitality, the sector hardest hit by the Covid crisis, continued its strong recovery, adding another 72,000 jobs during the month. Education and health added 65,000 jobs in March.

Economists, Wall Street, Congress, the White House, and most Americans are hoping that the good news on employment, in addition to the falling inflation numbers, will encourage the Federal Reserve to limit any interest rate increases to only a quarter of a point at their next meeting in May.

Update:_February 2023 - Despite what many believe to be the Federal Reserve's best efforts to beat down inflation by throwing the U.S. economy into a recession, the U.S. jobs market again outpaced expectations in February. February's job gain of 311,000 easily exceeded the consensus forecast of 200k to 225k, although the unemployment rate ticked upward to 3.6%.

Leisure and Hospitality, the hardest hit sector of the economy during Covid, continued its recovery in February, reporting an employment increase of 105,000. Construction saw its twelfth consecutive month of job growth, adding 24,000 jobs during the month. Notable employment gains also were seen in retail (up 50,000) and health care (up 44,000).

On the flip side, the information sector lost 25,000 jobs in February as the Big Tech companies continue to try and prop up their stock prices by eliminating jobs.

There was good news to report on inflation, as February's month-to-month increase in the Consumer Price Index (CPI) was only 0.4%. Economists also are reporting that virtually all of the worldwide supply chain issues, which have bedeviled American companies for a year and a half, are now behind us.

Update:_January 2023 - In a report that shocked economists and Wall Street, the U.S. economy added 517,000 jobs in January, trouncing the consensus estimate of 188,000. The unemployment rate fell to 3.4%, the lowest it has been since 1969.

These blowout figures occurred even as the labor force participation rate (the number of Americans either working or actively looking for work divided by the number of Americans in the work-age population) increased to 62.4%.

Of course this good news didn't sit well with Wall Street, at least not initially, as the major indices fell following the jobs release. The fear there is that the strong numbers will cause the Federal Reserve to continue increasing interest rates in an attempt to "cool" the economy and bring down inflation. But most inflation indicators show inflation to be easing, so we expect the stock markets will reverse course soon.

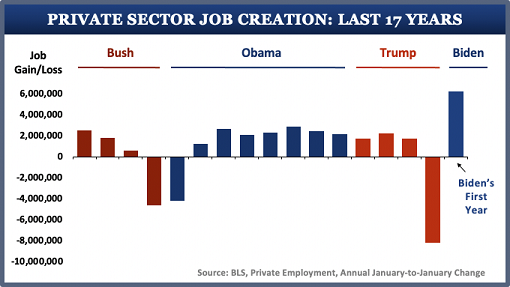

With jobs having grown by almost 12 million since he took office, the first two years of President Biden's term has seen more employment gains than any full four-year Presidential term in recent memory.

Update: December 2022 - Despite well-publicized layoffs in the tech sector, U.S job growth in December again exceeded expectations. 223,000 jobs were added during the month vs. the consensus forecast of only 200,000.

Leisure and hospitality, the sector hardest hit during the Covid years, continued its comeback with 67,000 new jobs being added. The construction sector, always an important barometer of the economy's health, saw an increase of 28,000 jobs.

Update: November 2022 - Another month-end and another U.S. jobs report that exceeded economists' and Wall Street's expectations. 263,000 non-farm payrolls were added in November, while the consensus forecast had been for only 200,000. Wages were up 5.1% year-over-year vs. an expected 4.6%.

Both of those higher numbers led to an early December fall in the U.S. stock markets as investors feared these signs of a strong economy would force the Federal Reserve to continue its hardline interest rate policies in an effort to slow the economy and, thereby, bring down inflation.

Leading the job gains in November was the leisure and hospitality sector with a net increase of 88,000. Among other sectors, healthcare added 45,000 jobs and construction employment grew by 20,000. Manufacturing was up 14,000 but retail fell by 30,000.

(Employment numbers continue to remain strong)

Update: October 2022 - Although job growth has cooled since the summer, the US economy added 261,000 jobs in October, easily exceeding the consensus forecast of 193,000. In addition, the Bureau of Labor Statistics amended the August and September job numbers, revising them upward by a total of 29,000. Manufacturing and leisure/hospitality, two of the sectors hit hardest by Covid, were among the leaders in October, adding 60,000 jobs (the most in 30 years) and 164,000 jobs respectively.

Another positive economic statistic reported for October was the year over year inflation number. The increase in that number was only 7.7%, which was lower than the 8+% of previous months and a surprise to many economists. The monthly change for the month of October itself was 0.4%, which equates to an annual rate of 4.8%, much closer to the Federal Reserve's 2% target. This unexpected good news sent the stock market soaring, in hopes that the Fed might begin to slow its year-long increase in interest rates.

Update: September 2022 - What recession? Once again, job gains for the month exceeded expectations, coming in at a positive 263,000, slightly above expectations. In addition, the third quarter number for overall U.S. economic activity, as measured by U.S. Gross Domestic Product, reflected a 2.6% annualized growth rate, reversing the slight decreases experienced earlier in the year.

While a slowing in consumer spending also was reported last month, which is a concern to some economists, the September growth in jobs and GDP belie the fear that the Fed's actions on interest rates are automatically going to push the U.S. economy into a recession.

Update: August 2022 - August's jobs report is being described by economists and investors as a "Goldilocks"-style report: not too hot and not too cold, i.e., perfect for our economy. Here's why: 1) Job growth remains strong but there still are twice as many job openings as people looking; these two statistics mean we are not in a recession, nor are they indicators of an impending recession. 2) More people are entering the labor force, which not only will help fill those open positions, but also will have an anti-inflationary impact on wages.

In other words, 1) it still is possible that a recession can be avoided despite the strong anti-inflation measures taken by the Federal Reserve and 2) as part of those measures, the Fed may not have to raise interest rates as high as has been forecasted.

Here are some of the specific numbers from the August report which support those optimistic viewpoints:

- Employers added 315,000 jobs in August, which was slightly over forecast, but down from the sizzling growth of recent months.

- The number of Americans in the work force increased to 62.4%, the highest level of the year.

- Wages (average hourly earnings) increased at a 5.2% rate over last year, which also is down from recent months.

In addition, gasoline prices continue to fall in the United States and around the world, another good sign for the U.S. economy:

GASOLINE PRICES

(Image from GasBuddy.com via Yahoo Finance)

Update: July 2022 - Reactions from leading economists to the July jobs report tell us all we need to know:

- "The July employment report was an absolute knock-out."

- "The unexpected acceleration in non-farm payroll growth in July, together with the further decline in the unemployment rate and the renewed pick-up in wage pressure, make a mockery of claims that the economy is on the brink of recession."

- "This remains one of the strongest job markets in the past 50 years."

Not only did the 528,000 increase in jobs double the consensus expectation for July, but May and June employment gains were revised upward as well. America now has recovered all of the 20 million jobs lost during the Covid recession. The unemployment rate fell to 3.5%, a 50-year low.

Update: June 2022 - Defying the doomsters who have been predicting a recession for months now (or those who already are arguing we are in a recession), U.S. employers again exceeded expectations with respect to job growth. 372,000 non-farm jobs were added during June, surging above the consensus estimate of 250,000.

Sectors leading the way in June were education and health services (+96,000), professional and business services (+74,000), and leisure and hospitality (+67,000).

On the labor front, average hourly earnings were up 5.1% over a year ago. The size of this earnings increase, in addition to the strong job growth experienced in June, have led most economists to believe the Federal Reserve (along with Central Banks around the world) will continue to raise interest rates as monetary policymakers do their part to lower the post-pandemic global inflation without pushing economies into a lengthy slowdown.

(Federal Reserve Chief Jerome Powell - image from NBC News)

Update: May 2022 - Non-farm employment increased by another 390,000 workers in May. Once again the actual monthly increase came in higher (by 65,000) than the consensus estimate (of 325,000). 69% of American industries added workers during May; the leisure and hospitality sector led the way with an increase of 84,000 jobs.

The nation's 3.6% unemployment rate remained unchanged this past month; this was due to an increasing number of workers having entered the labor force during May.

Following up on that last statistic: despite many Citizens having decided not to return to the job market immediately following the easing of the pandemic, the U.S. labor force (Americans either working or looking for work) now stands a 164.4 million workers, only 207,000 workers shy of the number just prior to the start of the pandemic.

Update: April 2022 - April's jobs report reflected an increase of another 428,000 American jobs during the month, exceeding the consensus expectations by 50,000. The U.S. unemployment rate remained unchanged at 3.6%.

Employment in leisure and hospitality, the sector hit hardest by covid, continues its comeback, increasing by 78k in April. Manufacturing jobs grew another 55k, while transportation and warehousing employment rose by 52k.

The U.S. dollar remains strong, buoyed by the economic performance of the United States, the interest rate measures taken by the U.S. Federal Reserve, and Vladimir Putin's invasion of the Ukraine.

Update: March 2022 - The U.S. economy added another 481,000 jobs in March and the unemployment rate fell to 3.6%. Following the release of these numbers, economists at Bank of America said, "The consensus was looking for a blow-out report and that is what we got."

The unemployment rate now stands just one-tenth of a percentage point higher than its pre-pandemic low; this despite the fact that the labor force participation rate increased again in March to 62.4%, as the number of Americans coming off the sidelines continues to expand.

Lastly, one more surprisingly strong number for March: the number of new unemployment claims for the week ending April 1 fell to 166k, the lowest since 1968. This is the third consecutive week that first-time claims were below 200k. The average in the pre-pandemic year of 2019 was ~218k per week.

US UNEMPLOYMENT RATE - graph from tradingeconomics.com and the Bureau of Labor Statistics

Update: February 2022 - February's jobs report continued the recent trend of exceeding expectations. The U.S. economy added 678,000 jobs during the month, blowing past the average expectation of ~430,000k. In addition, December's employment gains were revised upward by 78k to 588k and January's job gains now stand at 481k, an upward revision of 14k.

Virtually all sectors of the economy experienced an increase in employment during the month, which resulted in the nation's unemployment rate falling from 4.0% to 3.8%. This decrease in unemployment took place even while the labor force participation rate rose slightly from 62.2% to 62.3%.

The hard-hit travel and leisure sector built on its strong January numbers, adding another 179,000 jobs in February. Professional and business services experienced a gain of 95,000 payrolls and employment in construction was up 60,000.

January 2022 - The U.S. economic recovery continues to out-perform expectations. The December and January employment numbers were particularly good, given the concern over how Omicron and the world's supply chain issues might have affected the U.S. economy: job growth in January was 467,000 (vs. the forecasted number of 150k) and December numbers were revised upward to 510k.

Before we look at more details, though, let's take a step back and review what the forecasts were for 2021. Given the efficiency of both the covid vaccine and its rollout, expectations for the U.S. economy to bounce back by the end of 2021 was high last spring. But hesitancy by a third of the population to get vaccinated started lowering those expectations during the summer.

And then came Omicron, a more contagious covid variant that the vaccine could not prevent as easily as it did with the original disease and with the Delta variant. Consequently, Omicron was a concern for most economic forecasters, who feared that Americans might get sick at record rates (which did happen, albeit with relatively minor symptoms to almost all of the vaccinated). It was expected that such a surge in illnesses would lower employment numbers and reduce spending as most people became more careful of exposure.

Adding to these concerns were indications that global supply chain issues would affect the United States and all of our trading partners. While these issues were a natural consequence of the surge in consumer and business demand following the vaccine's successful rollout across the developed nations of the world, they still led many forecasters to lower economic growth projections even further.

But a combination of the 2021 Democratic stimulus (which did not receive any Republican support), the Federal Reserve's monetary policy, the continuing vaccine rollout, and both voluntary and mandatory masking/distancing policies allowed the U.S. economy to continue growing.

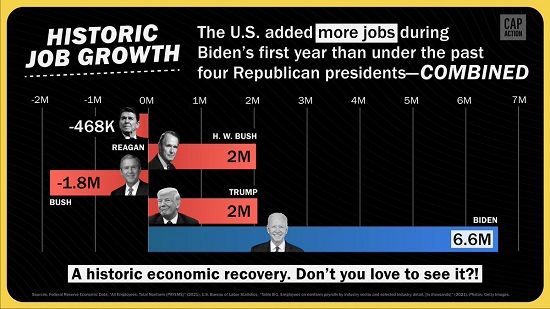

In fact, as seen in these graphs, job growth in the first year of the Biden Presidency exceeded any other single year going back to at least 2005 and easily exceeded the first year of the last four Republican Presidencies.

(Graph from the Bureau of Labor Statistics)

(Graph from CAP Action, sourcing Federal Reserve numbers)

While almost all segments of the US economy saw an increase in hiring during January, the retail sector's gain of over 61k jobs last month actually helped return that sector to its pre-pandemic level of employment. Some other sectors of note over the past year include warehousing/storage, where employment now exceeds February 2020 levels by over 30%, and construction, which is only 1.3% below pre-pandemic levels.

Particularly impressive, though, were the 151k jobs added in the leisure and hospitality sector. That area has been hit hardest by Covid over the past two years and is the first sector that many Americans limit their exposure to when Covid concerns flair up.

|