The National Debt and Federal Fiscal Policy

Introduction

When it comes to the federal government's fiscal policy and the national debt, don't let the far right politicians and their friends in the media fool you. Macroeconomics is the branch of economics that deals with managing the economy and basic macroeconomics is pretty straight-forward:

When the country is approaching or already in a recession, Washington should stimulate the economy by running annual budget deficits. When the economy is moving along smoothly or starting to overheat, the federal government should reverse that course, begin running annual budget surpluses, and pay down the accumulated debt. Over time, then, you end up with a negligible federal debt. Anyone who says the federal government should run a balanced budget every year is naïve at best.

Here's the detail behind why most economists believe this approach is the best way to manage a national economy:

What Happens During a Recession

Let's start by examining what happens during a recession. The most consistent aspect of any recession is a drop in aggregate demand. Aggregate demand is the sum of what households, businesses, and governments purchase. During a recession, the reason aggregate demand falls is threefold:

1) People without jobs aren't buying as much, because they don't have the money to spend. In addition, many people who still are working during a recession are afraid of losing their jobs, so they start spending less as well, saving a little more money than usual, just in case.

2) With fewer customers, businesses start producing fewer goods, so those businesses won't be buying and investing as much either.

3) With household incomes down and business profits down, it means that tax revenues are going down for all levels of government. If a government is legally obliged to run a balanced budget, as most of our states are, then government spending also falls.

Without intervention, these things tend to feed on themselves. As sales go down, businesses lay off more workers. Fewer workers with paychecks reduces the overall demand for goods, which causes more layoffs, which causes even less demand. With less people working and businesses making less money, tax revenues are down for state and local governments, who either have to lay off their own state employees (the worst solution, which a lot of states controlled by the Republicans did during the recent "Great Recession"), cut back expenditures, or raise taxes, (the latter two being what most states have done during economic downturns), all of which further reduces demand.

The result is a continuing downward spiral, which makes a weakened economy even worse.

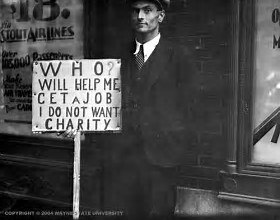

(Depression-era photo from umich.edu) (Depression-era photo from umich.edu)

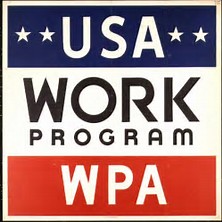

So what should we do in times like this? At the federal level, you make up for the decrease in aggregate demand by temporarily spending more, in order to help raise aggregate demand. Since consumer spending is down, as is business and local government spending, it's up to the federal government to try and make up the difference. One of our favorite ways to do this is on infrastructure projects: roads, bridges, the power grid, airports, etc. Our infrastructure always is in need of repair, and funding these projects is a quick way to put engineers, construction workers, suppliers, etc. back to work quickly. A second sound approach is to send money to the states (revenue sharing) so the states can maintain their levels of service without having to lay off workers.

When the federal government follows an approach like this, it puts more money in people's pockets, which increases demand and also increases tax revenues. The ripple effect is positive and will help turn around a falling economy. Witness the most recent recession of 2007-2009: although the fiscal stimulus enacted in 2009 was not as large as it should have been (we'll discuss this in a future article), the result of the fiscal stimulus (along with the Fed's monetary stimulus) has been a steady increase in private sector hiring that has continued into 2017.

Perhaps the best historical example of how macroeconomic policies work is to review what happened during the Great Depression of the 1930's. Following the stock market crash of 1929, Republican President Herbert Hoover continued to cut back federal spending, believing incorrectly that a balanced federal budget would improve the economy. The result was that unemployment moved from under 5% in 1929 to over 25% by early 1933. People were losing their homes, their farms, and could not feed their families. By 1933 many big city mayors were worried that there would be violence in the streets if conditions did not improve.

When Franklin Roosevelt (FDR) became President in 1933, and although he came into office believing that an annually balanced federal budget was a good thing, he eventually engaged in a fiscal stimulus program of public works. By 1940, the unemployment rate had fallen to under 10%. Most economists believe that FDR's biggest mistake was that he did not stimulate enough.

(Poster for FDR's WPA infrastructure spending program) (Poster for FDR's WPA infrastructure spending program)

The Good Times

Now let's look at the flip side. The economy is humming along nicely, people are working and buying big-ticket items, businesses are investing to meet peoples' demands for goods and services, and tax revenues are up. What should the federal government do? Answer: we should allocate a portion of those higher tax revenues to paying down the debt that accumulated during the recessionary times.

This was the biggest blunder that the Bush Jr. administration made in 2001-02 and is the primary driver for the federal debt being as large as it is today. You remember that, by the end of the Clinton years, the federal government had begun running an annual budget surplus for the first time in decades. President Clinton and Treasury Secretary Rubin used those funds to start reducing the accumulated federal debt from previous years. Economic projections estimated that the entire federal debt could be eliminated in little more than a decade.

But what did the Bush/Cheney team do with the budget surpluses they inherited? Unfortunately, they didn't continue to pay down the debt, did they? Rather, they decided to follow the guidance of the "trickle-down" theorists and pushed for big tax cuts aimed at the well-off, in the misguided belief that this would stimulate the economy even more.

The fact is that whenever taxes are cut back too far on the well-off, they don't use the money to stimulate the economy. Rather, economic studies have shown that the well-off use large portions (too much) of those tax cuts to buy real estate and invest in dubious financial instruments. In the 1920's, those financial instruments frequently were fraudulent stock offerings; in the 2000's they were non-regulated derivatives. And what were the results? Real estate bubbles and Wall Street failures, which caused the two biggest economic downturns of the past hundred years: the Great Depression of the 1930's and the Great Recession of 2008.

One final note: an additional unintended consequence of the Bush tax cuts for the well-off relates to the world economy that we live in today. Recent economic studies also have shown that up to a third of those dollars went overseas. You don't get much stimulative benefit to the US economy if people aren't investing in the US.

Summary

So the bottom line on federal fiscal policy is pretty simple: during recessions, the federal government should help increase aggregate demand by running annual budget deficits, with a heavy emphasis on funding infrastructure projects and aiding state governments. Then during the good times, run annual budget surpluses that pay down the debt accumulated during the recessions.

And be wary of any politician who thinks otherwise: when you hear one of them argue that the federal government should run a balanced budget every year, you better run the other way fast or you and the country will end up paying the price.

|